What is Total Cost of Risk Analysis?

A scenario planning framework which supports better resilience and insurability planning efforts.

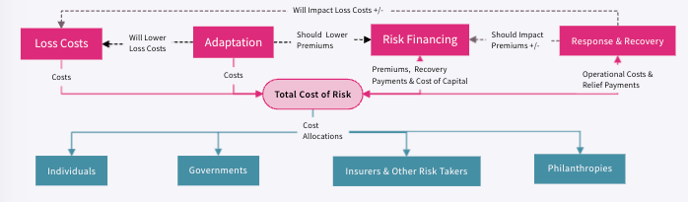

The InnSure Total Cost of Risk (TCOR) framework considers the following inputs, output and dynamic relationships.

- Probabilistic annualized component costs including

- Direct and indirect impacts/costs resulting from catastrophes.

- Investments in adaptation.

- Costs related to catastrophe response and recovery.

- Administrative and cost of capital necessary to finance expected loss costs resulting from catastrophes.

- An aggregation total costs under different investment scenarios,

- How costs are allocated,

Dynamic Relationship Between Costs

The TCOR framework considers the dynamic relationships between investments and other costs across the entire public, private and philanthropic funding systems for managing catastrophe impacts.

- Average annual loss (AAL) describes the cost of loss and damage a community is expected to experience. The AAL cost is calculated based on the expected frequency and severity of hazards and vulnerability of assets exposed to loss. The AAL can be described on an aggregate (community-wide) or on a per-capita basis for modeled catastrophe scenarios.

- Uninsured average annual loss (UAAL) costs is a key metric that describes a community's protection gap. Some of the AAL costs in a community may be insured, but a portion of the AAL costs may be uninsured. UAAL is what communities suffer the most from after disaster events. The protection gap for flood scenarios can be more than 95%.

- Climate adaptation investments bend the UAAL down by lowering the AAL. This can be achieved by reducing the average severity and/or frequency of losses.

- Insurance investments bend the UAAL down by transferring costs from uninsured to insured AAL,

- An investment's net cost effectiveness will be defined by its annual cost, compared

to its resulting change in UAAL and other co-benefits (e.g. if investment is a community amenity). - Capturing the value of locally focused adaptation projects in insurance markets often does not happen quickly. Transparent and trustworthy calculation of changes in UAAL can be used to advocate for more affordable and accessible insurance from public and private insurance programs and regulators.

![innsure_digital_color-Mar-05-2025-02-55-26-0329-PM.png]](https://23723343.hs-sites.com/hs-fs/hubfs/innsure_digital_color-Mar-05-2025-02-55-26-0329-PM.png?height=50&name=innsure_digital_color-Mar-05-2025-02-55-26-0329-PM.png)