What is insurability planning

A place-based and community-led strategic process.

Insurability planning is the strategic process of assessing and enhancing a community's capacity to access affordable insurance coverage by identifying, managing, and mitigating risks that would otherwise make insurance prohibitively expensive or unavailable. It involves creating conditions where insurance becomes both viable for insurers to offer and accessible for communities to purchase.

Insurability planning is most effectively led by community leaders who have the authority to influence key factors of resilience, including land use, infrastructure, and building codes. By weaving insurability planning into the fabric of local economic development and resilience initiatives, these leaders can more efficiently implement a comprehensive risk management strategy. This approach allows them to optimize investments in risk reduction, risk transfer, and emergency preparedness, ultimately enhancing the community's overall insurability.

Key Components of Insurability Planning

- Risk Assessment: Systematic evaluation of potential hazards and vulnerabilities specific to a community (floods, earthquakes, wildfires, economic shocks, etc.).

- Strategic Investments in Risk Reduction: Development of physical infrastructure and systems such as nature-based systems that reduce impact from identified risks at both an asset and a community level. This can also include behavioral-based efforts to influence adaptation related investment behaviors of consumers.

- Insurance Market Analysis: Understanding available insurance products, coverage gaps, and market limitations/failures.

- Regulatory Framework: Creating supportive policies that enable insurance markets to function effectively.

- Non-regulatory Insurance Market Interventions/Innovations: Using market-based levers such as group purchase, self-insurance pooling mechanisms and advanced analytics to shape how insurance markets quantify and price risk.

Categories of interventions/innovations included- Insurance product innovations such as micro insurance, parametric insurance, use of advanced analytics to create pricing incentives for investments into strategic investments into risk-reduction

- Insurance distribution/procurement innovations such as group purchase and/or embedded insurance schemes where insurance is delivered as a feature embedded in some other consumer engagement. This can also include behavioral-based efforts to influence insurance purchasing behaviors of consumers.

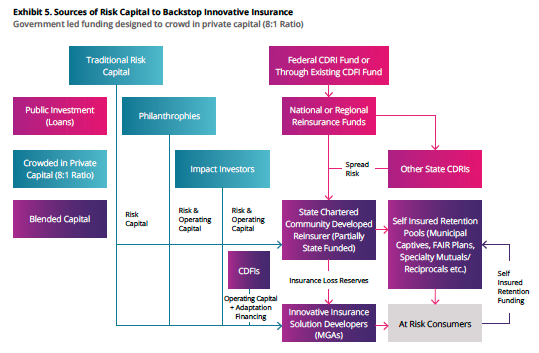

- Capital stack innovations such as Community Development Reinsurance. See white-paper.

Risks of Not Planning

- Municipal budget health and solvency of local governments may be in danger in the event of catastrophes and/or insurance markets reducing (or ending) coverage before catastrophes, leading to wiping out of portions of the tax base.

- The value of communities' climate adaptation investments will not be accurately assessed, leading to communities not prioritizing these investments and the insurance market not acknowledging these investments' risk reducing value.

- The comprehensive and long-term costs of community-wide risks, such as disruptions to the community's life and economic activity and displacement of households and businesses, will not be accounted for in the planning of risk transfer investments.

- Capital flows into communities to repair/rebuild/recover after catastrophic events will be too little and far too late.

- Community leaders will be unable to design, implement, or fund innovative Community Insurance programs that fulfill their communities' insurability needs.

Economic Benefits of Effective Planning

- Communities with higher levels of insurance coverage recover more quickly with lower costs to recover.

- Areas with established and effective insurance frameworks are more attractive to businesses and investors (including municipal bond investors).

- Properties in areas with accessible insurance maintain more stable property values and related tax revenues.

- Well functioning insurance markets will shift financial burdens of catastrophic events from individuals incapable of withstanding shock losses associated with disasters to pre-arranged risk financing mechanisms designed for such purpose.

![innsure_digital_color-Mar-05-2025-02-55-26-0329-PM.png]](https://23723343.hs-sites.com/hs-fs/hubfs/innsure_digital_color-Mar-05-2025-02-55-26-0329-PM.png?height=50&name=innsure_digital_color-Mar-05-2025-02-55-26-0329-PM.png)